The construction industry is standing at a crossroads. As extreme weather events increase in frequency and severity, the stakes for project timelines, budgets, and safety have never been higher. A recent episode of the American Global Tech Connect podcast dove deep into this pressing issue, exploring how technology and innovative insurance models are reshaping the way we approach weather risk. Below, we summarize the fascinating insights shared by industry leaders John Bter (PCL Construction), Mark Drum (American Global), and Josh Graham (EHAB).

Why Weather Risk Can No Longer Be Ignored

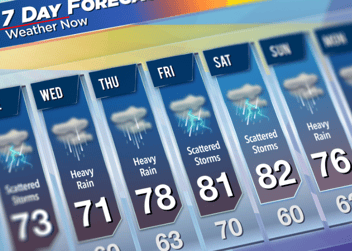

Chris Green, American Global’s VP of Innovation and Insights, opened the discussion with a sobering reminder: hurricanes Helen and Milton have left millions without power in their wake, and the construction industry has felt the impact acutely. With $147 billion in global weather-related losses in 2023 alone, it’s clear that extreme weather events are becoming a new normal.

“Contractors are not just builders—they’re risk managers,” noted Josh Graham, founder of EHAB. “Weather is one of those uncertainties that will always influence your job, no matter what.”

The Role of Technology in Weather Risk Management

John Bter of PCL Construction shared how his team is leveraging tools like IoT weather stations and Power BI to collect and analyze weather data. “We started small,” he said. “Things like weather stations give us localized data, and platforms like Power BI allow us to visualize that data for our field teams. But the challenge is scaling this regionally and across projects.”

Josh Graham added a layer of innovation with EHAB’s probabilistic modeling: “We’re not trying to predict the weather on a specific day. Instead, we model the probability of achieving a certain activity months or even years into the future. It allows contractors to adjust schedules and optimize productivity, knowing what’s likely to happen.”

This macro-to-micro approach—using long-term data for strategic decisions and short-term insights for daily operations—stood out as a game-changer.

Insurance: From Cost-Cutting to Necessity

The insurance industry, once a tool for managing unforeseen losses, is now adapting to the new realities of climate risk. “Underwriters are asking for data like never before,” explained Mark Drum, American Global’s SVP for Canada. “A few years ago, digital tools were used to drive premiums down. Now, they’re a prerequisite just to get coverage.”

Drum highlighted how insurers are reducing capacity and imposing stricter limits, particularly in high-risk areas. “You might see a $100 million project with only a $10 million flood limit in a high-risk zone,” he said. This creates a pressing need for solutions like parametric insurance, which pays out quickly based on pre-agreed triggers like wind speed or rainfall levels.

“Parametric insurance is fascinating,” said Graham. “It shifts the focus from damage to operational delays—the hidden, underestimated risk that can have huge cost implications.”

Collaborative Risk Mitigation

A key takeaway from the discussion was the growing importance of collaboration between contractors, clients, and insurers. As Bter explained, “We’re starting to see clients willing to invest in risk mitigation technologies themselves, like load stabilizers for cranes. It’s no longer just about contractors shouldering the burden—it’s a shared risk.”

This collaboration extends to planning as well. Graham emphasized the importance of proactive discussions during the bid stage: “With granular weather data, contractors can forecast risks accurately and build them into bids. It’s not about overestimating or underestimating—it’s about getting it right.”

Weather Impacts and Emerging Patterns

Mark Drum discussed unpredictable weather impacts like flooding and forest fires.

Josh Graham highlighted the complexity of compounding weather events: “It’s not just a severe day—it can be a severe week or month where you have combinations of events that haven’t been seen before. A heat wave can bake the ground, reducing its ability to absorb water, and then you get a summer storm that leads to unexpected flooding.”

This extended severity impacts productivity, safety, and even worker morale. “When you’ve had 10 hot nights in a row, the next day’s productivity can drop significantly because people can’t sleep and are more fatigued,” Graham noted.

Looking Ahead: The Paradigm Shift in Construction

The panel agreed that the industry is at a paradigm shift. “Predictive analytics is going to be a key driver,” said Drum. “We’ve moved from CAD to BIM, and now we’re entering an era where data isn’t just part of the process—it’s the process.”

For Graham, this shift represents an end to what he called the “climate honeymoon phase.” “We’ve had years of milder winters and higher productivity. But now we’re facing the offset: heavier rainfall, stronger winds, and more disruption.”

Final Thoughts

The construction industry is uniquely positioned to tackle the challenges of extreme weather head-on. By leveraging technology, embracing data-driven decision-making, and fostering collaboration, contractors can turn risk into opportunity. As Bter pointed out, “It’s not just about knowing the weather—it’s about planning for it and ensuring the morale of your team and the trust of your client.”

To dive deeper into these insights, watch the full podcast episode above and explore how these transformative ideas can shape your projects for the better.