Climate change and predictability

Climate change is a key driver of risk in construction today. As more CO2 is absorbed and retained in the atmosphere the global average temperature goes up. It's going up more quickly in some places than others, the Arctic for example has warmed 4 times quicker than the rest of the globe, since 1979, read more here. Climate change risks are not only caused by global carbon emissions but by many other factors as we will discuss today.

This increase in temperature is enabling the atmosphere to hold more water vapour and therefore more powerful and violent rain events are occurring.

For every degree of warming the atmosphere can retain an extra 7% of moisture. This trend toward more extreme weather events is incredibly clear. A good general rule of thumb is that wet places are getting much wetter, and dry places are getting much dryer. Nobody wins.

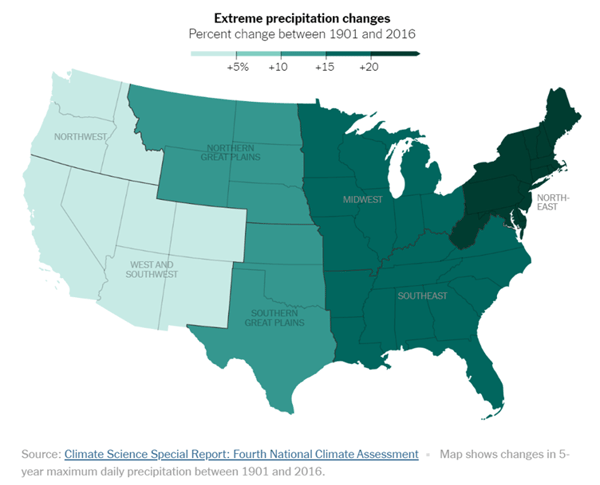

In the United States there is a stark divide which the below map shows. The Western half of the country is getting dryer, and the Eastern half is getting significantly wetter. The New York Times have written a more detailed summary of the science here.

This increase in extreme weather means that the cost of managing these climate related risks in the construction industry is going up. That’s a fact.

But the second more insidious result of the climate crisis in the construction sector is decreasing predictability. Traditionally the industry would know that winter was a bad season to build in and summer was a good season. But this is no longer the case, and it's a much more hidden climate risk as you no longer know where you stand.

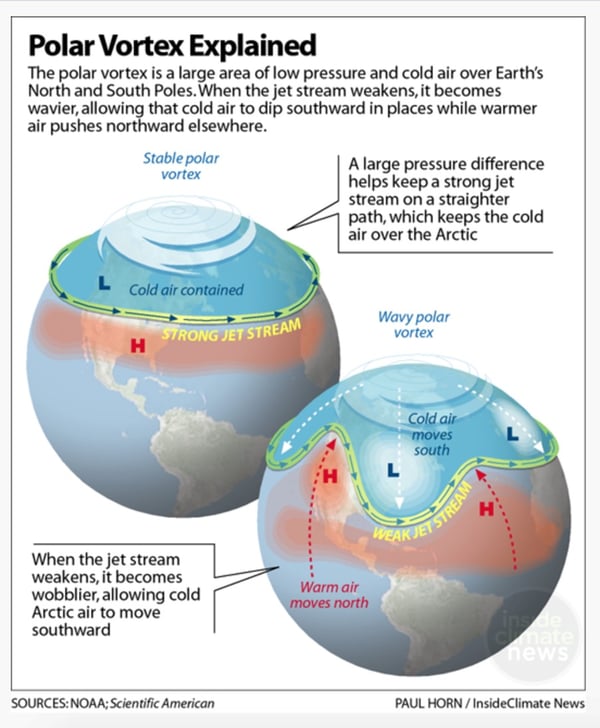

Winter might be getting warmer on average, but cold snaps can still occur and potential cold snaps seem to be getting more severe and become a concern as a climate related risk. In 2021 we saw several cold snaps break records, in Texas, Spain and Greece, much of this extreme weather caused issues across the economy as well as in the construction industry.

These events occurred because of the weakening of the jet stream. The image below illustrates how this band of strong winds in the upper atmosphere usually traps arctic temperatures in the arctic, but as climate change disrupts this stream there can be an occasional weakening, bringing arctic temperatures to the UK, like in the historic 'Beast from the East' of 2018.

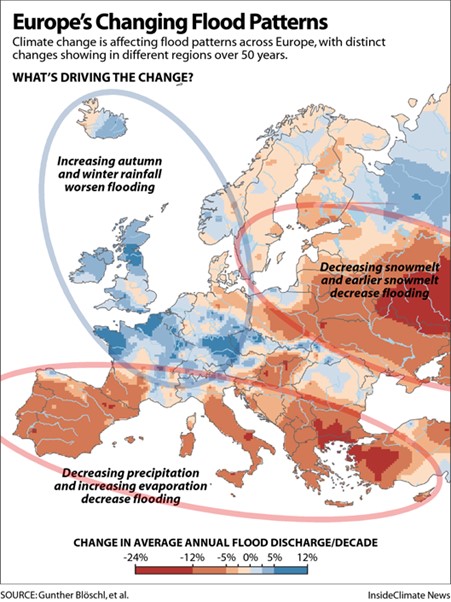

Hot weather in summer is baking the ground so that if extreme rainfall occurs, even in short bursts there can be flash floods as caused in 2020.

This isn’t to mention the decreased productivity that comes from hotter temperatures. Having a strong system to ensure climate resilience in 2022 is a must. Researchers at Loughborough University, led by Professor George Havenith, discovered in a 2020 study that there is a 35% decrease in productivity throughout the workday when operating at temperatures of 35°C/50% relative humidity, going up to 76% reduction when the thermometer reaches 40°C/70% relative humidity.

For example, in Europe, although rainfall patterns are shifting Northwards, as the below map shows, there is still a significant risk of flooding in the now increasingly arid areas. This is due to the parched earth actually repelling water rather than absorbing it. Find out more about the change in Europe here.

How is a construction company supposed to compete with this level of unpredictability? You are no longer able to rely on mitigation and management alone. Something else has to fill this gap in predictability.

The gaps of traditional insurance

So the weather is getting less predictable. Isn't this what insurance is for? Yes, insurance traditionally is for the unexpected events that can severely impact your project. Payouts have been rising in recent years because of this increase in exposure in the industry. 2021 was a 10 year high in terms of payouts in the wider insurance sector.

However, this means that insurers are facing mounting losses and are putting up premiums everywhere to account for this new reality. They are also removing certain inclusions that might have been standard practice a few years ago. This could mean flood or a host of other items are removed, pushing these costs onto the balance sheet of contractors.

Insurance very rarely pays for delay costs, and this is becoming rarer, traditionally physical risks are the main losses covered. If your projects all start suffering increased wet weather and other severe impacts on a regular basis across your whole portfolio then do you really have a large enough risk pot to manage this increased delay risk? Some years might see sporadically wet weather, but others could be catastrophic, with strong rains everywhere and a cold snap in winter forcing sites into shutdown mode. That's the unpredictable world we now occupy.

This is the big protection gap with traditional insurance. Only delay costs associated with damage can be recuperated through these normal policies, and any other places where you did have some inclusions that could fill the gaps are now being removed as we face a harder market for the next few years or more. Physical climate risks will retain some of their protection, but delay is the next big place for innovation to take hold.

What is parametric insurance?

Parametric insurance has been around since the 80s and has been used by agricultural and energy companies for decades. The basic premise is that the insured chooses a threshold. They choose a pay out. When that threshold is met as per some third party data agreed upon by the insurer and company then the payout occurs. This can take a few hours, as opposed to months for more traditional payouts.

Traditional insurance has to rely on adjusters to go and uncover the value of the loss event and agree the occurrence of damage linked to the event.

In the case of parametric the only thing that matters is the data stating that the event occurred. The only downside is that there could be some basis risk. In other words the event that happened might not have caused loss, or not as much loss as was paid out for, or indeed not enough was paid out for the loss.

This basis risk however can be mitigated with increasingly accurate modelling of how events might create loss, such as the EHAB platform and it’s ability to model weather losses.

The benefits are rapid payout, no admin for the claim and the policy being able to be positioned as the insured needs. Perhaps this can help pay for standing costs from a severe weather delay. Perhaps the payout can cover late fees for a disrupted weekend possession. There are a huge number of use cases.

How does parametric plug the gaps?

Parametric is appealing because savvy contractors and clients can identify where the potential gaps are, where climate exposure is, and they can plug them. Some construction companies have used parametric policies before and have suggested that parametric is expensive. However, this is a misnomer. The policy can be priced very accurately because the likelihood of the event can be calculated. This means the insurer can know the extent of the potential loss and ultimately how much they will probably have to payout.

You as the insured are in control of what the level of threshold for payout is and what the payout should be so you can be the one to play around with these levers until you achieve a level of cover and affordability that you are happy with.

As a contractor you might see your NEC as being very fair in terms of weather risk. But the constraint of the calendar month creates a severe level of exposure. What if the event occurs over the split of a month? What if you have three 1 in 9 months in a row? Parametric could be used to cover these gaps. If you are working under a JCT or other type of contract then you will see extreme weather giving you extra time under the contract but you will be covering the cost of this. Is your risk pot big enough to cover the standing costs of multiple projects if more named storms keep disrupting your sites?

As a client under the NEC you are being left on the hook to pay for most of the extra weather risk being put as a time risk allowance in the contract, and you are likely to need to pay for the increasing number of compensation events. Parametric insurance could be used to cap the total expense you might need to pay out on an infrastructure project.

Why is automation and speed key to resilience?

Being proactive with risk management is the best and cheapest way to manage risk. Parametric insurance can be part of an arsenal to ensure you are as proactive as possible. In the case an event has happened, you would usually need to assess the damage, start the clear up process and file an insurance claim and a compensation event claim. Extra work that takes your team away from focusing on getting back on schedule.

Getting yourself back on track after an extreme event is hard work and costly. You might need to clear up the site from debris, or pump water from the site and workers might not be able to reach the site before transport networks are cleared.

With the EHAB product in particular you will be able to model the likelihood of these events so that in the first instance you are aware of the potential implications of a severe event. You're prepared. Using the modelled data you will then have created a bespoke parametric cover that will immediately start paying out so you and your team can focus on getting back on schedule.

Your client will be happy because this policy could have covered some of the costs they needed to pay you as the contractor, and you can get back to work knowing your margin hasn’t taken a hit from a severe event.

What is needed to make the revolution happen?

Construction companies need to first be able to quantify the risks they are taking today. If there’s no clear way to know how much money you are paying to deal with the weather then you can’t know how to transfer it away.

Quantifying risk in this way requires analysis of as many of your projects as possible. Something that no company in the construction industry is doing today.

Once you have analysed all the risk on your projects you need to quantify where your contracts are covering you but also where they are not. Armed with this knowledge then you can really understand what your loss from weather could be.

This point should be made to your client, because any risk the contract does cover is still a cost to your client and they may be able to seek a joint cover with you to protect you both from spiralling costs.

You then have to look at these risks and structure policies that would save or cover the losses where they occur. The good news with parametric is that pricing can be made more quickly as loss is more predictable.

This means you can play around with those levers we mentioned earlier and this lets you build the perfect weather risk transfer structure.

The final thing that is needed is a recognition that weather and climate risk are real and that they are going up and that as a company you should start prioritising this.

Using the EHAB platform we can begin analysing your projects and start to create a picture of what your weather risk really looks like and help you understand the price of protecting your balance sheet.

How can your construction company adapt to make the most of this trend?

You need a weather risk and climate risk management platform that helps you identify and quantify the risks you are taking.

You need a platform to manage these risks and lower your exposure as much as possible. Once you have done this, then you will be able to identify the level of exposure that is hard to manage and is a good candidate for parametric insurance.

If you are curious to learn how you and your insurance or risk team can understand more about this type of cover then please don’t hesitate to reach out. We will be happy to host a free consultation to understand where you are as a business and how climate resilient you already are.