Introduction: A New Era for Alternative Data

Weather has long been a background variable in trading models — assumed, averaged, or ignored entirely.

But that’s changing.

As climate volatility accelerates, top-performing quant funds are treating weather as a direct input into alpha models. They’re not just looking at the forecast — they’re ingesting structured, probabilistic weather signals that explain and anticipate market movement.

In this post, we break down:

-

Why weather is emerging as one of the most overlooked alpha signals

-

How funds are integrating these signals into models

-

What makes EHAB’s WeatherWise data uniquely fit for trading applications

Why Weather Is Becoming a Core Signal

1. It’s a First Mover

Unlike macroeconomic releases or earnings reports, weather happens before the market reacts — giving traders a first-mover advantage if they can quantify it correctly.

2. It’s Uncorrelated

Weather impacts supply chains, infrastructure, and commodities, but behaves independently of traditional market drivers — offering clean diversification for signal stacks.

3. It’s Getting More Volatile

As climate patterns shift, historical norms are no longer predictive. The firms that understand forward weather risk will outperform those stuck in backward-looking models.

What Most Funds Get Wrong About Weather Data

Most quant desks that explore weather start with:

-

Free or raw GFS/ECMWF forecast data

-

Historical correlations with asset classes

-

Basic lagging indicators (e.g. temperature vs gas demand)

These methods:

-

Lack context (Is the weather impactful to infrastructure or not?)

-

Miss lead time (Too close to event = too late to trade)

-

Require internal interpretation (Costly to operationalize at scale)

In contrast, EHAB’s WeatherWise Signals deliver:

-

Pre-calculated indicators (like “concrete pourability” or “diesel demand disruption”)

-

Probabilistic timeframes (e.g. 7-day risk of delay in port X)

-

Geo-asset specificity (signals tied to actual infrastructure and market exposure)

Where Weather Signals Create Trading Edge

Here’s how quant teams are using EHAB’s signals today:

Energy Trading

-

Predict power outages, fuel demand spikes, or LNG disruptions

-

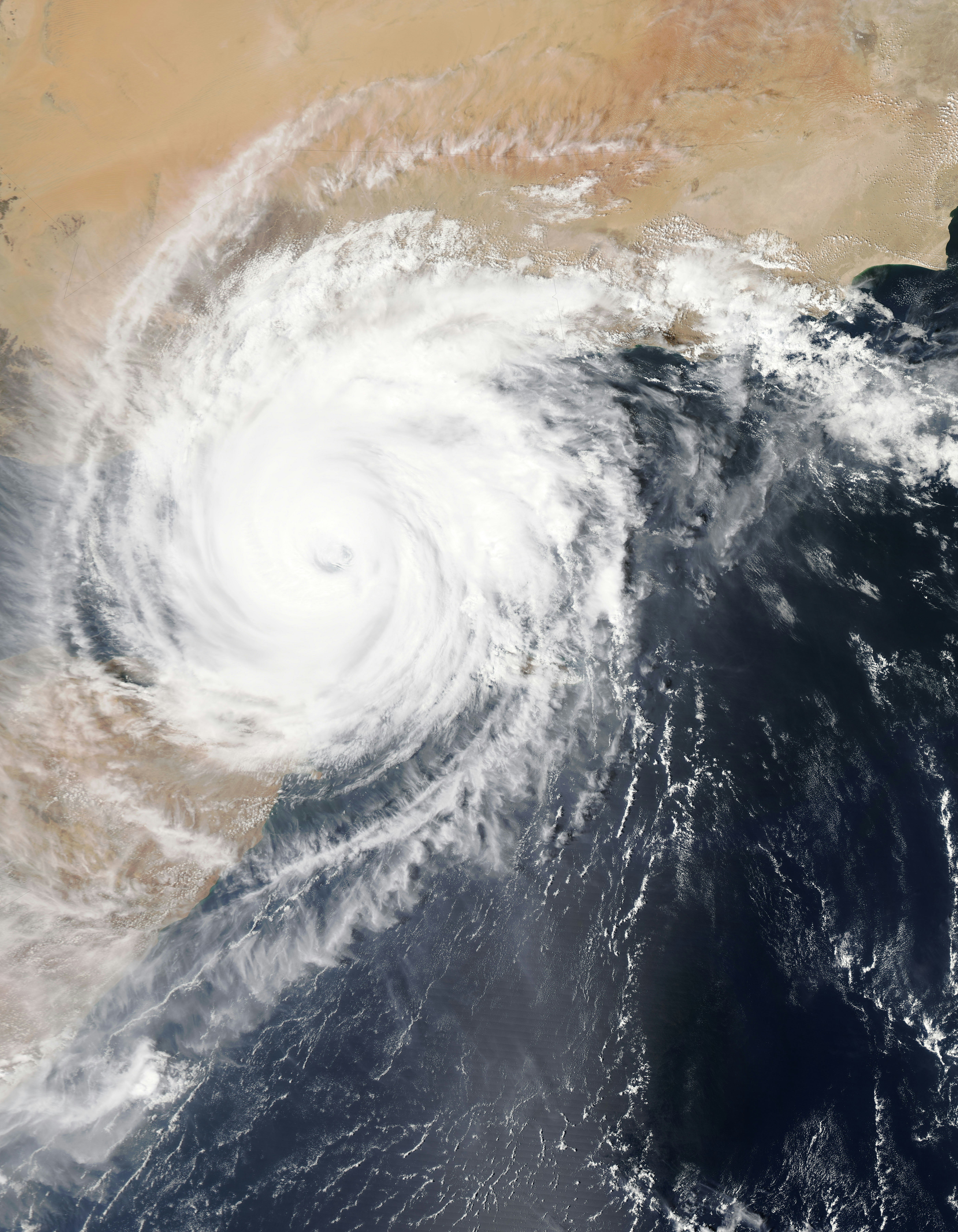

Monitor Gulf storms and extreme wind probabilities affecting transmission lines

Ag Commodities

-

Model yield risk with rainfall, temperature, and soil moisture indexes

-

Use EHAB’s forward indicators to anticipate USDA surprises

Infrastructure & Materials

-

Track risk-adjusted downtime forecasts to anticipate construction demand dips

-

Forecast raw material delivery delays or seasonal shutdowns

Alpha Example: Delay Risk as a Signal

Imagine you’re modeling copper supply risk. EHAB provides a 10-day forward “infrastructure delay signal” for key regions in Chile.

The signal shows an 85% probability of multi-day mining delays due to heavy rainfall.

Trade reaction: You adjust futures exposure, anticipating tightening supply — ahead of public reports or analyst revisions.

Why EHAB’s WeatherWise Signals Stand Out

Unlike other data providers, EHAB:

-

Models operational impact, not just meteorological conditions

-

Delivers ready-to-integrate signals via API or dashboard

-

Has proven skill scores (94% avg. accuracy across forecasts)

-

Supports custom strategy development in collaboration with quant teams

Whether you’re running systematic models or discretionary strategies, these signals provide a structured weather edge that’s rare in the alt data world.

The Future: Weather as a Factor

Some leading funds are even exploring “weather as a factor” in multi-factor models — placing it alongside volatility, momentum, and macro sentiment.

As access to refined, high-skill weather data increases, we expect:

-

More hedge funds building internal weather desks

-

A shift from forecast consumption to signal execution

-

Growing demand for forward risk pricing across asset classes

Get Ahead of the Weather Curve

If you’re serious about signal diversification, now’s the time to integrate structured weather intelligence.

👉 Book a call to discuss your model needs

Let’s turn environmental volatility into your trading edge.

Final Thoughts

Weather has always shaped markets. Now, it’s finally being priced in intelligently.

With structured, probabilistic signals, quant funds are turning unpredictability into outperformance — one storm at a time.